Singapore investment and asset management company High Street Holdings has flagged plans for further hotel purchases in Australia after acquiring Rydges North Sydney for $75,000,000.

CBRE Hotels negotiated the sale of the 167-key hotel on behalf of Event Hospitality & Entertainment.

The High Street Holdings acquisition was negotiated on behalf of a Singapore family office, which last year made its first Australian tourism acquisition with the purchase of the Kennigo Hotel Brisbane.

High Street Holdings partner David Marriott said the family office was actively pursuing further Australian investment opportunities as part of the continued diversification of its global portfolio.

“The transparency of the Australian market and the strength of domestic demand, which accounts for circa 80% of hotel visitation numbers, continues to be a key attraction in light of the volatility in international tourism in recent years,” Mr Marriott said.

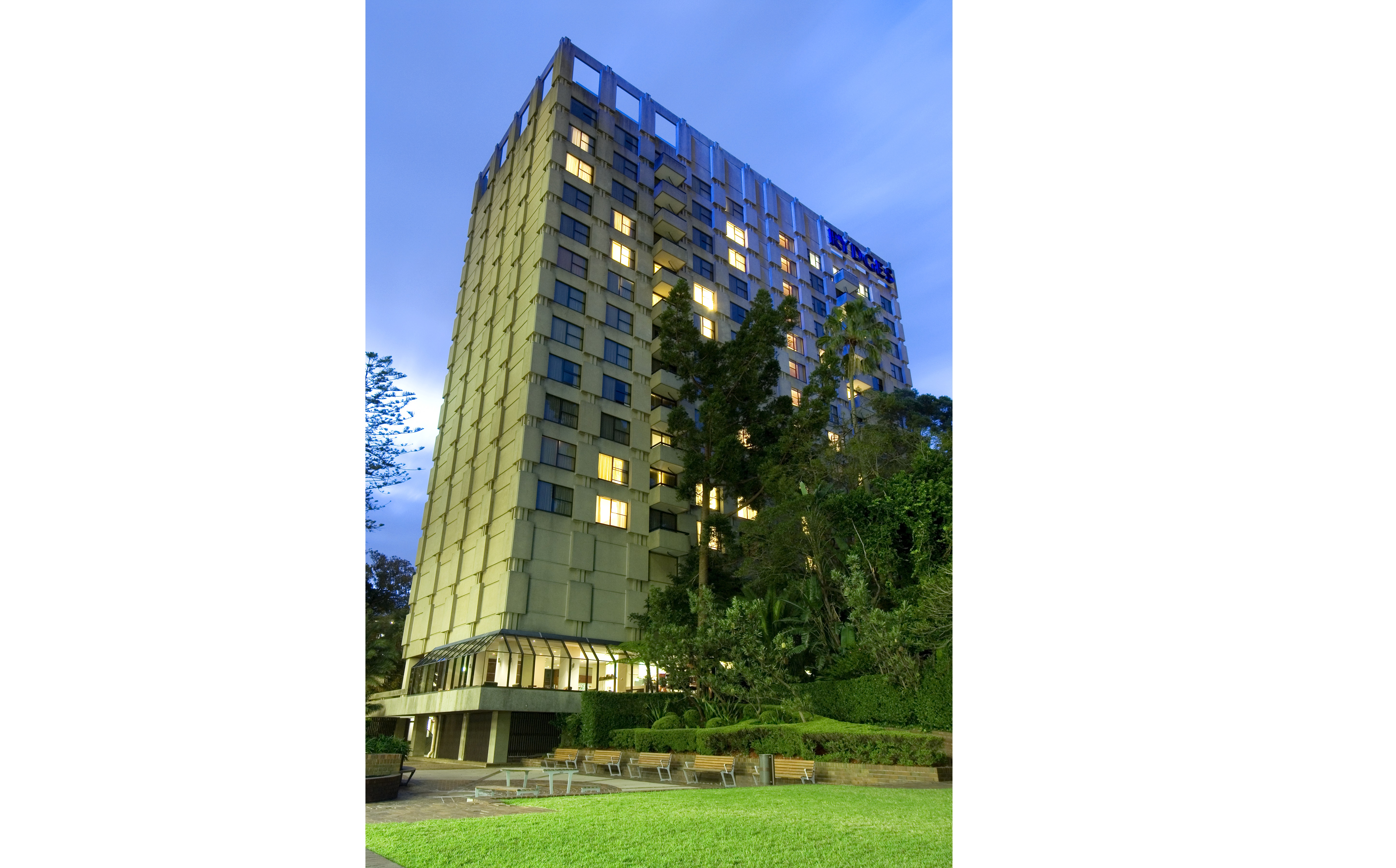

Located at 54 McLaren Street, Rydges North Sydney occupies a significant 2,549sqm freehold site in one of Australia’s largest corporate catchments. A refurbishment of the hotel will be embarked on post-settlement.

CBRE Hotels’ National Director Wayne Bunz noted, “Sydney is a truly global city, renowned as a global tier one investment destination with hotel assets highly sought after but tightly held. This sale highlights the recent rebound in demand from Asian-based capital reinvesting into Australian hospitality and accommodation assets.”

Rydges North Sydney is situated just off Miller Street, next to the upcoming Victoria Cross Metro Station, which will connect North Sydney and the hotel with the Sydney CBD in around three minutes.

CBRE Hotels’ Managing Director Michael Simpson added, “There is circa $8.4 billion of large-sale development projects either under construction or in the planning stages in the North Sydney precinct, including the new 60,000sqm Victoria Cross office project adjoining the hotel. Combined with the 61,000sqm 1 Denison Street and 42,000sqm 100 Mount Street office towers, this significant influx of commercial projects and limited hotel supply bodes well for the local accommodation market.”

Find more accommodation for sale HERE.

Find the latest industry news HERE