More accommodation businesses for sale than anywhere else in Australia

Motels, Hotels, Caravan Parks and Management Rights for sale

Browse Australia-wide listings with specialist pages for Sunshine Coast, Gold Coast, Brisbane, Melbourne and more.

Management Rights

Explore permanent, holiday and mixed-use management rights across Australia. Find vetted opportunities with recurring income.

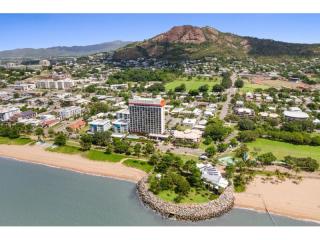

View Management Rights for saleHotels

Search freehold and leasehold hotels for sale. From regional pubs to city assets. Filter by state, region and price.

View Hotels for saleMotels

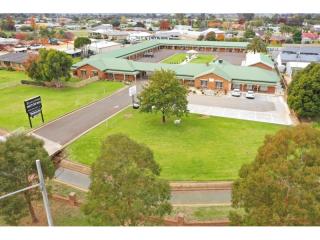

Find freehold going concern and leasehold motels for sale nationwide. Compare revenue, occupancy and location.

View Motels for saleCaravan Parks

Browse caravan and holiday parks for sale. Review site mix, amenities and region to match your investment goals.

View Caravan Parks for sale